On 9th September, at a press conference to mark 100 days of the Modi government’s second term, Mr Gadkari said, NHAI had no financial problem and would continue its high spending ways.

The Union minister for road transport & highways, Nitin Gadkari, and the chairman of the National Highway Authority of India (NHAI) have responded with characteristic aggression to reports about the precarious financial health of the bloated NHAI. But this time, the criticism has come from the prime minister’s office (PMO).

Is NHAI in Fine Financial Health? Or Will India Pay for Needless Bravado?

The nub of the matter is that NHAI’s debt soared from Rs 40,000 crore in 2014, when the Modi government took over, to an unsustainable Rs 1.78 lakh crore in 2019 under Mr Gadkari’s watch. In August, the PMO reportedly wrote to NHAI saying the organisation has become “log-jammed with unplanned and excessive expansion of roads” and that road infrastructure has become financially unviable. It asked NHAI to discontinue construction of roads and monetise assets.

Immediately after that, NHAI’s former chairman told a television channel that NHAI’s contingent liabilities are at least twice its outstanding debt. This adds up to anywhere over Rs3 lakh crore – a number corroborated by those who do business with NHAI. A study by SBI Caps Securities (SBI Caps) corroborates this.

Mr Gadkari is unconcerned. On 9th September, at a press conference to mark 100 days of the Modi government’s second term, Mr Gadkari said, NHAI had no financial problem and would continue its high spending ways. Projects worth Rs 5 lakh crore will be announced by the year-end and NHAI is targeting to build 4,500 km of roads in FY 19-20 against 3,900 km in the previous year.

NHAI’s chairman, Nagendra Nath Sinha, speaking at an industry event, was even more dismissive about any criticism. “Either people don’t understand what contingent liability is or the numbers have been over-reported.” And, yet, NHAI’s debt is expected to touch Rs 2.5 lakh crore (trillion) by the end of this financial year requiring Rs 25,000 crore to service interest alone.

So what happened to PMO’s letter? Doesn’t it matter? Mr Gadkari’s response has been to kill the messenger. The NHAI official, who allegedly put the letter on social media, has been suspended and Mr Gadkari has threatened ‘strict action’.

But it is hard to put the genie back in the bottle and concerns about the viability of NHAI’s many projects will continue to be discussed. The government intends to push infrastructure spending to boost consumption and reverse the decline in economic growth. Finance minister Nirmala Sitharaman has earmarked Rs 100 lakh crore for infrastructure development, a chunk of which ought to go into road building.

But Mr Gadkari’s statements suggest that he doesn’t need Budgetary support, apart from the Rs 90,000 crore that, he says, has already been allocated to his ministry.

Unfortunately, Mr Gadkari tends to make many contradictory statements or assertions that are not backed by commensurate outcomes. For starters, why has NHAI’s massive spending had little impact on consumption and economic growth in the past five years? Hasn’t NHAI’s debt soared because land acquisition costs have gone through the roof? Isn’t this mainly because land acquisition costs have soared?

According to a report by SBI Caps, land acquisition costs are up by an average 30% on an annualised basis since 2013. Add to this the padding of costs by various players, repeated cost escalation due to delays and lack of clearances, and you have unviable projects or non-starters which have no impact on the economy.

NHAI’s growth comes through a combination of Budgetary allocations and borrowings. Mr Gadkari, in his public speeches and press conferences, has asserted that his road projects are not unviable in spite of high land acquisition costs; at the same time, he has said that banks have now turned cautious about funding highways (they already have large exposures to corporate India, including in the failed Infrastructure Leasing & Financial Services).

“We have enough money coming from foreign pension funds, private equity funds who want to buy roads (under the toll-operate-transfer model),” he says. And, yet, NHAI’s key source of funds continues to be public sector institutions, banks and pension funds. Consider this:

The Life Insurance Corporation (LIC) has extended a 30-year loan of Rs25,000 crore to NHAI last year. NHAI expects to raise more funds from LIC this year and also tap the EPFO (Employee Provident Fund Organisation).

On 10th September, State Bank of India (SBI) chairman, Rajnish Kumar, said that the Bank is looking at lending Rs35,000 crore to NHAI through securitisation of toll receipts. Lending to NHAI, a government entity, is a safe bet for the Bank irrespective of whether or not toll collections or cash flows would cover NHAI’s costs.

An implied sovereign guarantee makes this lending risk-free (hence, NHAI enjoys high credit ratings); because, if estimates about toll receipts are wrong or fanciful, the cost will be borne by the exchequer. Mr Gadkari clearly expects a lot more from SBI. He has said, “We can raise Rs 100,000 crore to Rs 150,000 crore from SBI alone and from other banks also we can go for a similar arrangement.”

But not all lenders are sanguine about lending to State entities. The Maharashtra government, set for elections in two months, has provided a Rs 13,000 crore guarantee for interim loans for MSRDC’s (Maharashtra State Road Development Corporation) mega-ambitious and controversial Nagpur-Mumbai Expressway, despite strong objections by the finance department. The cost of this six-lane, 710 km road has soared to Rs 55,335 crore; land acquisition is incomplete and it faces farmer agitations.

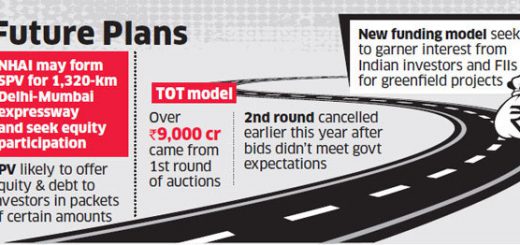

But Mr Gadkari is unfazed. He has promised a 1,250km Delhi-Mumbai Expressway at a stupendous Rs 1 lakh crore to be completed before the next general elections. He also insists that the 4-6-8 laning of highways, which is not always necessary, but is perceived as an excuse to impose extortive tolls, will also continue without a pause.

Another issue that Mr Gadkari is oblivious to is the simmering anger among road-users. He does not respond to the outrage over the poor maintenance of tolled roads, sloppy toll collection causing long delays, the repeated collection of tolls and steady escalation in charges.

“Toll is never going to end. Even after the cost has been recovered from the projects, the toll collection will continue. NHAI getting toll income in perpetuity is a very good proposition,, he declares with total insensitivity.

Mr Gadkari has also steadfastly ignored pleas from transport unions who went on strike in 2015 on the issue of delays at toll plazas. They cited a 2012 study by Transport Corporation of India (TCI) and IIM Kolkata which said tolls cost the country Rs 60,000 crore a year due to delays and stoppages.

Interestingly, transporters were not against tolling—they had offered to reimburse the government for all toll collection, including private cars, based on data provided by toll operators. It was rejected, giving rise to suspicion that policy-makers have a vested interest in continuing with the inefficient toll collection system.

No wonder, the promise of 100% ETC (electronic toll collection) at all toll plazas is still largely talk. Activist Sanjay Shirodkar says, in most places there are no dedicated lanes, awareness or discipline. He has proved that bids for toll and maintenance contracts are based on massive under-reporting of traffic data, in collusion with government organisations.

When toll rates and frequency of collection has increased, why haven’t toll collections? The SBI Caps report of August 2019 says that toll collection has grown by a modest 6% per km (from Rs 55 lakh/km in FY12-13 to Rs 80/km in March 2019). And, yet, the minister is gung-ho about tolling people in perpetuity!

There is a lot to be done beyond tolling. For instance, another report by TCI and IIM Kolkata in 2014-15 on “Operational Efficiency of Freight Transportation by Road in India” has estimated the cost of delays (due to check posts, etc) at $6.6 billion per year and the cost of additional fuel consumption due to delays was estimated at US$14.7 billion per year.

This was to be addressed by the E-way bills under the Goods and Services Tax (GST). But Mr Shirodkar says that this only addresses the tax issue; other stoppages causing delays remain unaddressed.

Addressing this is also a part of Mr Gadkari’s remit, but he has preferred the easy option of increasing fines for all traffic offences to such ridiculous levels that it has led to a harsh backlash and even violence.

Significantly, the Gujarat government has slashed fines for compoundable offences, announced by the Centre, by a sharp 90% and the Maharashtra government, which has not notified the new fines, also seems headed that way.

Since both states have strong Bharatiya Janata Party (BJP)-led governments, one wonders whether this is just a self-serving pre-election decision by the two states or an indicator of political differences at the top.

No large infrastructure project in India is complete without massive cost overruns. Often, cost escalation is announced even before construction commences and final costs are sometimes a multiple of the original estimate.

This is often due to the collusive nexus between project operators, government organisations and politicians. With banks and lenders insisting on state guarantees, the eventual cost of unviable projects or losses will be borne by the people.

In the 1990s, the United Progressive Alliance (UPA) government, led by the Congress, permitted high-cost power projects with guaranteed returns. We, as consumers, continue to pay very high tariffs two decades later, when power generation costs have fallen drastically.

Unless Mr Gadkari’s bravado about pressing ahead with unviable projects is checked, future generations will pay the price for expensive roads and freight transportation.

Source: http://bit.ly/2kOzLRt

Recent Comments