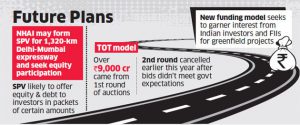

NHAI toys with equity offer to raise funds

NHAI is working on re-bundling the second round of TOT auction, the new funding model seeks to garner interest from Indian investors and foreign institutional investors for greenfield projects.

NEW DELHI: The National Highway Authority of India (NHAI) is looking to rope in equity partners for funding highway projects in a bid to raise more funds and get around the problem of muted private investment.

To begin with, the NHAI is likely to form a special purpose vehicle (SPV) for the 1,320-km Delhi-Mumbai expressway and seek equity participation, a government official aware of the matter told ET.

“We are exploring a possibility of forming an SPV for the (Delhi-Mumbai) project. The land acquisition costs will be borne by NHAI,” the official said.

“For funding of construction posts, the SPV will offer equity and debt to investors in packets of certain amounts.”

This mechanism will need a cabinet approval and that will happen once the new government is formed. The contours of the new model will be ready in the next three months, the official said.

NHAI has held preliminary discussions with the National Investment and NSE 0.11 % Infrastructure Fund (NIIF). “We are getting good feelers from financial investors, pension funds on this,” the official said. The government had introduced the Toll Operate Transfer(TOT) model in 2016 for monetisation of publicly-funded highways. Under the model, investors make a one-time lump sum payment in return for long-term toll collection rights backed by a sound tolling system. The first round of TOT auctions exceeded government’s expectations to fetch over Rs 9,000 crore. However, the second round of auctions expected to garner Rs 5,362 crore, was cancelled earlier this year as the bids received were far below the government’s expectations.

While NHAI is working on re-bundling the second round of TOT auction, the new funding model seeks to garner interest from Indian investors and foreign institutional investors for greenfield projects.

“We’ll have to gauge the response of long term investors because it is obviously a very large project, the cost of which will upwards of Rs 20,000 crore. So the first point is no one will purchase the SPV because it is very expensive, like TOT,” said Vinayak Chatterjee, Chairman, Feedback Inra, explaining the rationale for the move.

“So they want to give chunks of equity to long-term investors so that it is almost like a consortium funding,” he added. It would be interesting for NHAI to test out the structure with investor meetings in India and abroad and test the appetite and tweak it in a manner that will make it more acceptable to investors, he added. “It’s an idea worth pursuing,” Chatterjee said.

Truck suvidha always best platform for pro trucking knowledge . thanks truck suvidha for your extreme efficient coordination in logistic trade .