Commercial vehicle sales to gain from scrappage policy

by Ajay Bali · Published · Updated

-

Allocation of ₹1.18 trillion for infra projects will also spur demand for commercial vehicles

-

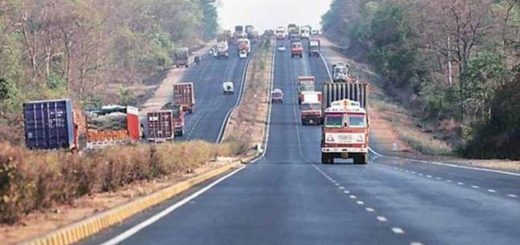

Commercial vehicle sales which have been falling since the collapse of IL&FS were worsened by the pandemic

The vehicle scrappage policy, urban transport initiatives, and record infrastructure spending announced in the Union budget 2021-22 are expected to boost demand for trucks and buses, benefiting commercial vehicles (CV) manufacturers like Tata Motors Ltd, Ashok Leyland ltd and Volvo Eicher Commercial Vehicle Pvt. Ltd.

CV sales, which have been falling since the collapse of Infrastructure Leasing and Financial Services Ltd and revised load-carrying norms, were worsened by the covid-19 pandemic. Sales across categories declined by 28.7% to 7,17,688 units in FY20, while the same for medium and heavy commercial vehicles dropped by 42.4% to 2,24,806 units. In the April-December period last year, dispatches further declined by 37.2% to 3,58,203 units.

Finance minister Nirmala Sitharaman on Monday outlined a vehicle scrappage scheme for CVs older than 15 years and personal vehicles older than 20 years, which will be detailed by the roads ministry later. The Union government will also spend ₹18,000 crores to introduce 20,000 new buses in cities, in collaboration with private companies. The record allocation of ₹1.18 trillion for infrastructure projects will also spur the demand for commercial vehicles.

Scrapping of older vehicles will create demand for new vehicles and a proposed green tax on vehicles will add pressure on fleet owners to replace their old trucks.

Companies such as Mahindra and Mahindra Ltd and Suzuki Motor Corp. have already invested in facilities to recycle vehicles.

According to Vipin Sondhi, managing director and chief executive, Ashok Leyland, the budget have several positive signals for the manufacturing and commercial vehicles sector, which are key to the economy and there are four specific areas that provide an impetus to the sector.

“The commitment to augment our country’s road infrastructure with projects for building 8,500km of highways and economic corridors augurs well for surface and road transport. The ₹18,000-crore scheme to augment public transport in urban areas with the addition of 20,000 new buses in a PPP (public-private partnership) model would ensure cleaner and efficient public transportation and ease congestion,” Sondhi added.

He said the voluntary scrappage policy is positive, but the industry has asked for an incentive-based scheme for it to be effective.

The CV industry, though, has started to recover from the December quarter as infrastructure projects resumed with the unlocking of the economy. Improvement in manufacturing has helped as well.

“With the announcement of infrastructure for roadways, we see even more demand for BharatBenz products in the construction tipper segment where we already enjoy a growing customer base. Furthermore, the push towards increasing national highway corridors will help improve inter-state connectivity; thereby creating a stimulus for fresh demand in urban transportation. Overall, the scrappage policy and infrastructure spends will trigger the demand for the MHCV segment,” said Satyakam Arya, managing director, and chief executive, Daimler India Commercial Vehicles

Recent Comments