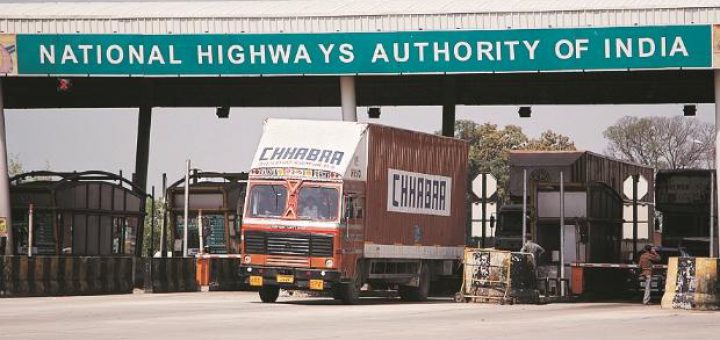

जीएसटी को ट्रांसपोर्ट लाइन के लिए फायदेमंद मानते हैं ट्रांसपोर्टर अख्तर हुसैन

अख्तर हुसैन ने अपनी मेहनत के बलबूते ट्रांसपोर्ट लाइन में सफलता हासिल की है। ट्रांसपोर्ट लाइन में बीते कुछ समय में जो पोजिटिव बदलाव आए हैं, अख्तर हुसैन उन्हें इस लाइन के लिए आक्सीजन...

Recent Comments