Truck sales set to rise ahead of rule change

Fleet operators are set to advance truck purchases ahead of an impending change in rules, which could push up prices by as much as Rs.60,000- 80,000.

The price increase will be on account of a new safety legislation that will come into effect from 1 October and will make features such as anti-lock braking system (ABS) and a speed-control device mandatory for trucks.

While the legislation allows selling trucks without such features till 31 March 2016, it prohibits production of such models from October. To beat the deadline, a number of firms are increasing production leading up to October.

“There’s no evidence in July of the pre-buying. But we do expect the fleet operators to prepone the purchase in the next few months,” said Ravi Pisharody, executive director, commercial-vehicles business at Tata Motors Ltd, adding that “whenever the regulation changes, some arbitrage comes into play”.

Tata Motors, the market leader of the trucks segment, is increasing the production month-on-month by 15% till October, said a supplier, requesting anonymity.

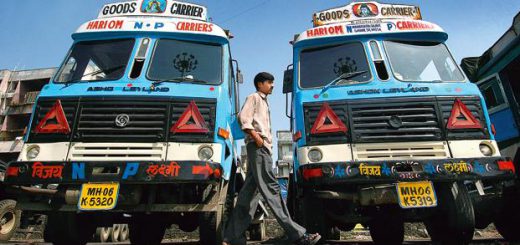

Others, such as Ashok Leyland Ltd, Eicher Motors Ltd and BharatBenz, are also increasing production in anticipation of fleet operators advancing purchases.

Truck makers expect to pass on the additional costs they incur in installing the new features in trucks. The hike for Tata Motors, said Pisharody, could be up to 5%.

Typically, pre-buying gathers momentum in the last month before a regulation change or price hikes come into effect, said Vinod Aggarwal, chief executive at VE Commercial Ltd (VECL), a joint venture of Sweden’s Volvo Group and Eicher Motors. The company, therefore, expects volumes to see spurt in September.

VECL will increase production in line with the market demand, said Aggarwal, declining to specify the increase in production.

Sales of medium- and heavy-duty trucks (with gross vehicle weight ranging from 16 tonnes to 49 tonnes) have been rising since June 2014, as fleet operators started replacing ageing vehicles after a three-year lull, hoping for a pick- up in demand from the infrastructure, construction, mining segments and improvement in consumer sentiments, which, in turn, perks up demand for consumables.

In the three months to June, sales of such vehicles rose 24% to 50,332 units over the year-ago period, according to industry body Society of Indian Automobile Manufacturers, or Siam.

Sales growth could pick up further in the next couple of months, albeit temporarily.

Sudarshan Shreenivas, associate director with India Ratings and Research, says that while the trend will push up volume growth in the months leading up to the regulation change, macroeconomic data remains weak, which may be a dampener for sales growth in the months ahead. “The IIP (index for industrial production) for the last three months has been muted. Even the export-import data has not been encouraging,” Sreenivas said, adding that this will impact demand growth.

IIP growth fell to 2.7% in May after a 4.1% growth in April and a 2.5% growth in March.

VECL’s Aggarwal expects the first-time buyers to enter the market only after six months when the infrastructure projects take off in a big way.

Tata Motors’ Pisharody said so far, the growth in the markets is being solely driven by haulage, or cargo trucks, and the contribution from tippers, which are deployed in mines and construction, has been almost negligible.

While all the enablers will help the market to grow in the quarters ahead, there is little visibility beyond the current fiscal on the way demand will pan out, he said.

Source: http://www.newsunited.com/truck-sales-set-to-rise-ahead-of-news/17572819/

Recent Comments