Evaluate toll-operate-transfer highway

Evaluating the highways ministry’s third bundle of toll-operate-transfer (TOT) highway projects, officials aware of the matter said.

NEW DELHI: Leading infrastructure investors including Cube Highways, Macquarie Group, IRB Infrastructure and Larsen & Toubro (L&T) have sought more time for evaluating the highways ministry’s third bundle of toll-operate-transfer (TOT) highway projects, officials aware of the matter said.

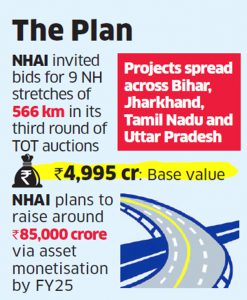

National Highways Authority of India invited bids for nine national highway stretches for a cumulative length of 566 km on June 13 in its third round of TOT auctions. The projects are spread across Bihar, Jharkhand, Tamil Nadu and Uttar Pradesh, with a base value of around Rs 4,995 crore.

“Major infrastructure players like Cube Highways, Macquarie, IRB, L&T among others, have asked for an extension. We held a road show on TOT recently, so we will need to give them some time,” a government official told ET.

The government introduced the TOT model in 2016 to monetise publicly funded highways. Under the programme, investors make a onetime lump sum payment in return for long-term toll collection rights. The highways ministry plans to aggressively monetise its assets under the TOT mode.

Union minister of road transport and highways Nitin Gadkari has said NHAI plans to raise around Rs 85,000 crore through asset monetization by FY25.

The technical bid submission for the project was due on Wednesday, and has now been postponed to September 30. “Many potential bidders have asked for more time, because they have not been able to complete their due diligence,” a second government official said.

At a TOT road show in August, NHAI chairman NN Sinha had said the third round of auctions had drawn interest from 27 companies.

“We want to gather wider participation in this bid. At a recent roadshow in Mumbai, investors asked for more time for bid submission, following which the deadline must have been extended,” another official said.

The first round of TOT auctions garnered the government Rs 9,681 crore, against the initial estimated concession value of Rs 6,258 crore set by the government. The Macquarie Group emerged as the winning player, with Brookfield Asset Management, IRB Infrastructure and Roadis-National Investment and Infrastructure Fund in the list of other bidders. The second round, however, were cancelled in February this year as response from the developers remained tepid.

Recent Comments