GST: a new road for transportation and logistics industry in India

India is all set to usher in a game-changing tax reform—the goods and services tax (GST). Apart from creating a unified market across India, GST will help make India’s manufacturing competitive by cutting high logistics and warehousing costs.

The regulatory reforms proposed in the GST presents a golden opportunity to revisit, rationalize and re-engineer transportation and logistics networks, given the inherent inefficiencies with taxes based on the crossing of administrative boundaries or border checkpoints. Taxation at a national level, rather than by each state, will result in more efficient cross-state transportation, streamlining paperwork for road transporters and bringing down logistics costs.

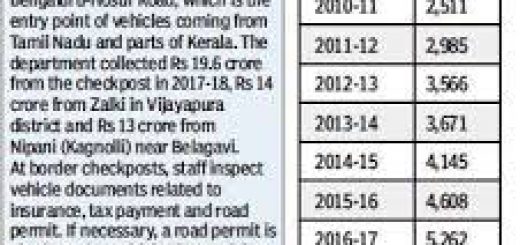

Currently, each of India’s 29 states taxes goods that move across their borders at different rates. As a result, freight that moves across the country is taxed multiple times. Worse, there are long delays at inter-state checkpoints, as state authorities review and examine freight and apply the relevant taxes and other levies.

Truck delays average five-to-seven hours at inter-state checkpoints. This, combined with other delays, keep trucks from moving during 60% of the entire transit time. As much as 65% of India’s freight moves by road, a fact which leads logistics experts to see GST as critical for India. High variability and unpredictability in shipments add to logistics costs in the form of higher-than-optimal buffer stocks and lost sales, pushing logistics costs in India to two-to three time’s global benchmarks, according to the World Bank.

Simply halving the delays due to roadblocks, tolls and other stoppages could cut freight times by some 20-30% and logistics costs by an even higher 30-40%, according to World Bank estimates. This alone can go a long way in boosting the competitiveness of India’s key manufacturing sectors by 3-4% of net sales.

The planned GST system seeks to replace around 15 state and federal taxes and tariffs for a single tax at the point of sale. The prevailing complicated tax structure in India meant that logistics decisions, including the choice of setting up inventory and distribution centres, are taken based on the tax regime such as central sales tax and state value-added tax (VAT) rates, rather than on operational efficiency. Tax optimization and administration is often considered over the operational and logistics efficiency.

GST will unleash a new era of developing logistics infrastructure and take investments to the next level. Given that the inefficient and longer supply chains with warehouses in almost every state is fiscally preferred in the existing regime, it is now time to overhaul and compress the entire logistics set-up. Last week, the Indian cabinet approved for introduction in Parliament a constitutional amendment Bill to implement the much-awaited GST that seeks to unify India into a common market by replacing levies imposed by states and the centre. GST, when implemented, will free the decisions on warehousing and distribution from tax considerations, which, henceforth, would be based purely upon operational and logistics efficiency, according to consulting firm KPMG India Pvt. Ltd. This will lead to changes in logistics requirements of clients, forcing logistics service providers (LSPs) to rethink their business operations, including creating new warehousing and logistics locations and expanding or closing existing warehouses at certain other locations.

In fact, networks and infrastructure associated with warehousing and logistics hubs are expected to be the most affected in the entire supply chain when GST takes effect. Network and infrastructure related businesses would get drastically realigned, ensuring proximity to manufacturing locations or consumption centres and ultimately resulting in hub-and-spoke models.

From the infrastructure perspective, the new scenario would reduce the number of warehouses but will increase their sizes, leading to a consolidation of the currently widely spread warehouses across states. This would translate into expansion of some of the existing warehouses, development of new ones and shutting down of several existing set-ups. LSPs and their end-users both would need to re-engineer their supply chains, focusing on optimal locations for warehouses and logistics centres.

GST will score over the existing regime in the transportation and logistics industry, where a tendency is seen to engage with the unorganized players for tax considerations. The GST regime will see the emergence of the organized service providers since taxes will no longer be added costs for the businesses. Given the highly fragmented nature of the Indian transportation and logistics industry (the leading 10 listed firms command less than 5% of the overall market), implementation of GST is expected to unleash a plethora of opportunities for companies in the organized sector.

Further, the firms in the unorganized sectors, too, would be expected to improve their service levels if they intend to successfully grow in the likely shape up or shape-out competitive landscape, says KPMG. The post-GST regime is, in fact, likely to offer many more unseen opportunities for unorganized entities to tie up or collaborate with established companies. This could ultimately result in a win-win scenario for both the collaborating parties and the industry at large.

GST, combined with the dismantling of inter-state check posts, is the most crucial reform since the economic liberalization in 1991 that can significantly improve domestic and global competitiveness of Indian manufacturing firms.

Recent Comments