Roller-coaster ride for commercial vehicles

The uptick was aided by a low base effect since commercial vehicles sales had nearly ground to a halt during the first few months of FY18 due to a shortage of BS-IV compliant parts.

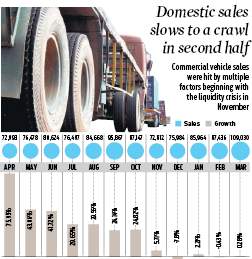

At first glance, India’s commercial vehicles segment seems to have signed off the previous financial year (2018-19) with rather respectable figures: achieving the 1 million domestic sales mark for the first time ever, selling 1,007,319 units, and recording an annual growth of 17.6 per cent. But, the year has been a roller-coaster ride for the industry, with sales growth going from a gallop in the first few months to a crawl in the second half of the year.

The numbers tell the tale. According to data from the Society of Indian Automobile Manufacturers (SIAM), the overall commercial vehicles segment began FY19 with a sharp 76 per cent rise in sales, selling 72,993 units in April.

The uptick was aided by a low base effect since commercial vehicle sales had nearly ground to a halt during the first few months of FY18 due to a shortage of BS-IV compliant parts. The Indian auto sector had transitioned to BS-IV emission standards in April, 2018. The segment went on to post sales growth rates of 43 per cent, 41.7 per cent and 30 per cent in the following months of May, June and July.

But, a combination of factors resulted in a sharp reversal in growth post November, when growth stuttered to 5.7 per cent and went on to turn negative in December at -7.8 per cent. Sales have remained relatively flat since. While the gradual fading of the base effect played a part, a decline in overall consumer demand seems to have been a major factor, as have the tightening of finance post the NBFC crisis and new axle load norms.

“When construction doesn’t happen, demand for medium and heavy CVs falls. We have been seeing low inflation and relatively low retail consumer demand, which would have hit smaller CVs. And finally, there is a certain portion of demand that is generated from depreciation-related tax benefits. But, when profits are hit, this factor doesn’t arise,” noted auto expert Kumar Kandasamy of Deloitte, adding that the liquidity crunch and axle loan norms may have also played a part.

ICRA Ratings’ analysts meanwhile, point out that “the adverse impact of tightening financing environment following the liquidity crunch, surplus capacity created through revised axle load norms and viability pressure for SFOs because of higher fuel cost and weak freight rates collectively impacted CV demand”.

However, they add that the reduction in the pace of decline over the last couple of months offers some hope. While ICRA feels the impact of the above headwinds will need to play-out in the near term, it believes “the outlook for FY20 remains supported by potential pre-buying ahead of the implementation of BS-VI emission norms (from April 2020 onwards)”, since vehicle prices are expected to increase by approximately 10-12 per cent after the implementation. Companies too expect the situation to improve. “We are hopeful that the demand will once again pickup after the elections,” says Tata Motors’ Commercial Vehicle business chief Girish Wagh.

Source: http://bit.ly/2IDgxca

Recent Comments