TCI expected to be major beneficiary of GST, ecommerce growth

Gurgaon based Transport Corporation of India (TCI) is expected to be one of the major beneficiaries of implementation of GST and growth in ecommerce.

Its vast network of 1,400 branches, 10.5 million square feet warehouses and 9,000 owned and managed trucks makes it difficult to emulate.

“We have over 6,000 trained staff and several decades of relationship with the customers gives a competitive edge over other players,” said Vineet Agarwal, managing director of TCI.

TCI primarily operates in four segments freight, express, supply chain and seaways division. In the freight division, the firm provides transportation of full truck, less than truck load (LTL) and parcel services.

It has a price escalation clause with most of its customers which allows them to pass on fuel price hike. TCI uses its own and hired trucks for road transportation, while it has a JV with Container Corporation of India (ConCor) for rail freight, thereby ensuring efficient cargo movement.

Due to its established network of warehouses and branch network, the company will be one of the chief beneficiaries of the booming ecommerce industry.

According to a BCG re port , Indian ecommerce market is expected to grow at a CAGR of 30-34% in the next five years. As a result, the logistics spend of ecommerce companies would grow four-fold by 2020.

Another growth driver for the company will be the implementation of GST. With a uniform pan-India tax system under GST, companies may outsource logistics needs to third party logistics companies, thereby reducing overall costs.

“Implementation of GST will lead to need for larger warehousing and more movement to hubs. It would also mean lesser paper work and faster movement of trucks,” said Agarwal.

In FY16, the company plans to incur a capex of Rs 275 crore, of which 60% would be for setting up of warehousing hubs. Besides, the company is planning to de-merge its express division into separate entity, which will enhance shareholder value in future.

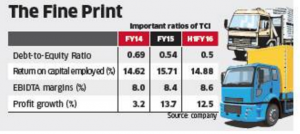

At Friday’s closing price of Rs 329.3, the stock traded at a price-to-earnings multiple of 29. With 15% return on capital employed in the first half of the fiscal, the company has been performing well despite the slowdown.

Investors looking for an exposure to the booming ecommerce sector may consider the stock for further research.

Source: http://auto.economictimes.indiatimes.com/

Recent Comments